When it comes to managing your finances, choosing the best bank for a checking account is a critical decision. The right bank can offer you convenience, affordability, and a range of features that make your day-to-day banking hassle-free. On the other hand, a poorly chosen checking account could lead to unnecessary fees, limited accessibility, and a lack of useful tools. That’s why it's essential to do your research before committing to a bank.

Whether you're looking for online banking options, no monthly fees, or a wide network of ATMs, there’s a checking account out there that fits your needs. In this guide, we’ll delve into the top options available today, comparing features, benefits, and potential drawbacks. We’ll also answer key questions you may have about finding the best bank for checking accounts and provide tips for making an informed decision.

By the end of this article, you'll have a clear understanding of what to look for and which banks stand out in 2023. From online-only banks to traditional institutions, we’ll cover everything you need to know. Let’s get started with our ultimate guide to finding the best bank for checking accounts!

Table of Contents

- What Makes a Checking Account the Best?

- Top Features to Look For in a Checking Account

- Why Choose the Best Bank for Checking Account?

- How to Choose the Right Bank for You?

- Best Bank for Checking Account with No Fees

- Which Bank Offers the Best Online Checking Account?

- Top Traditional Banks for Checking Accounts

- Are Online Banks Better for Checking Accounts?

- How Does Customer Service Impact Your Choice?

- Banks with the Most ATM Access for Checking Accounts

- High-Yield Checking Accounts: Are They Worth It?

- How to Avoid Hidden Checking Account Fees?

- Best Bank for Checking Account for Students

- Best Bank for Checking Account for Small Businesses

- What to Consider When Switching Banks?

What Makes a Checking Account the Best?

Choosing the best checking account involves more than just looking at the monthly fees. You need to consider factors like accessibility, security, interest rates (if applicable), and the bank’s reputation for customer service. The best bank for checking accounts will balance affordability with convenience and offer features that cater to your lifestyle.

Top Features to Look For in a Checking Account

Here are some key features to prioritize when searching for the best checking account:

- No or low monthly maintenance fees

- Wide ATM network or reimbursement for out-of-network ATM fees

- Online and mobile banking capabilities

- Overdraft protection

- High security and fraud prevention measures

Why Choose the Best Bank for Checking Account?

Having the best checking account can save you money, offer you peace of mind, and make managing your finances easier. Whether it's avoiding fees or accessing your money anytime and anywhere, the right account can significantly improve your banking experience. The best bank for checking accounts ensures you have all the tools you need to manage your money efficiently.

How to Choose the Right Bank for You?

When selecting a bank, it’s essential to evaluate your financial habits and needs. Are you someone who frequently withdraws cash, or do you rely more on digital transactions? Do you prioritize customer service, or are you looking for the lowest fees? Knowing your priorities will help you choose the best bank for checking accounts tailored to your requirements.

Best Bank for Checking Account with No Fees

Many people are on the hunt for a no-fee checking account. Banks like Ally Bank, Discover Bank, and Capital One stand out for offering checking accounts without monthly maintenance fees. These banks also provide other perks, like free ATM access and digital tools for account management.

Which Bank Offers the Best Online Checking Account?

Online checking accounts have become increasingly popular due to their convenience and lower operating costs. Some of the best banks for checking accounts in the online category include Chime, SoFi, and Axos Bank. These banks offer user-friendly apps, no overdraft fees, and high interest rates on deposits.

Top Traditional Banks for Checking Accounts

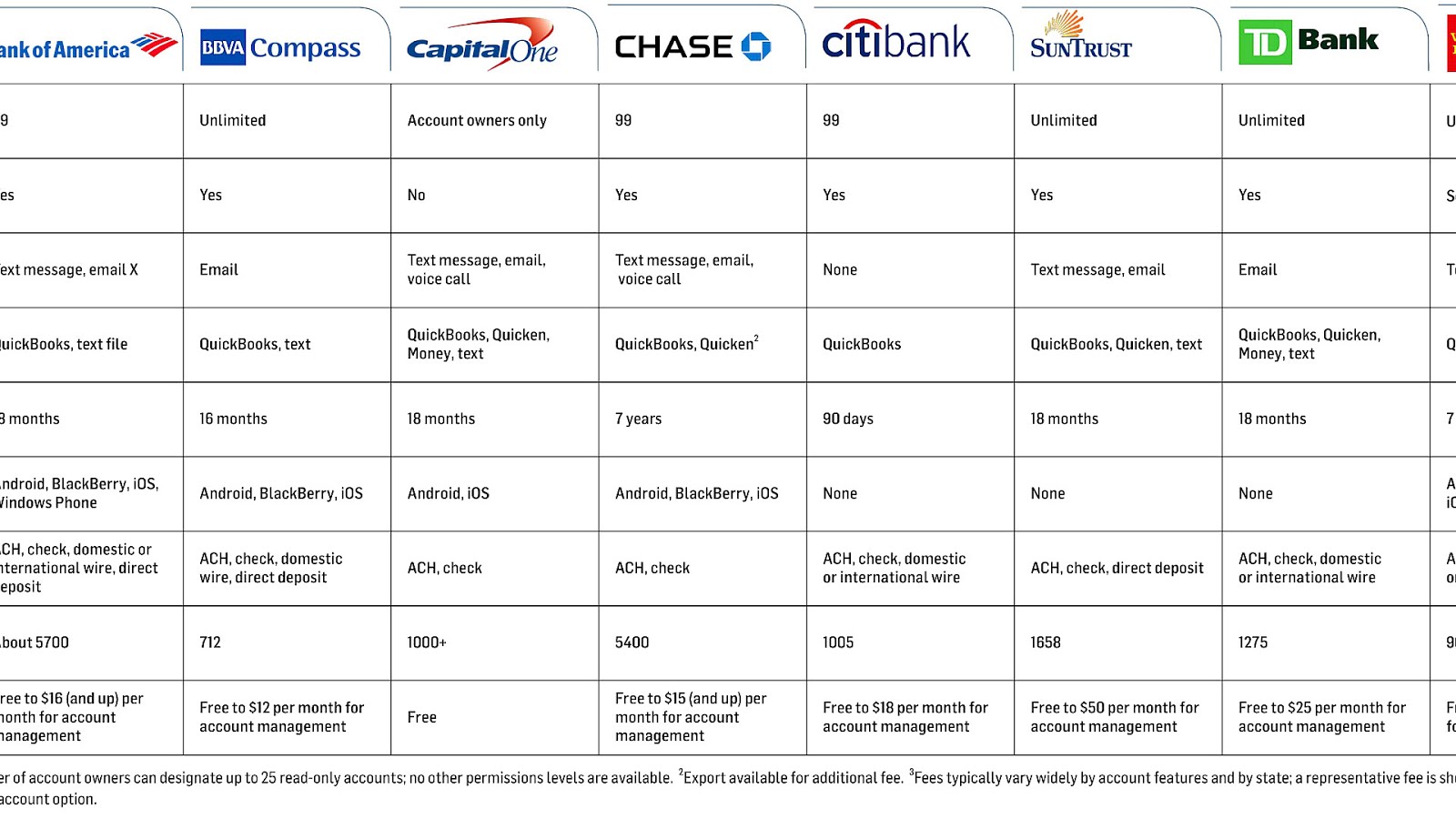

If you prefer the reliability of traditional banks, options like Bank of America, Chase, and Wells Fargo are worth considering. They offer extensive branch and ATM networks, robust customer service, and a variety of account features.

Are Online Banks Better for Checking Accounts?

Online banks often provide better interest rates and lower fees compared to traditional banks. However, they lack physical branches, which may be a drawback for some customers. Whether an online bank is better for you depends on your banking habits and preferences.

How Does Customer Service Impact Your Choice?

Exceptional customer service can make a significant difference in your banking experience. The best bank for checking accounts will have multiple channels for support, including phone, email, and chat, ensuring you get assistance when needed.

Banks with the Most ATM Access for Checking Accounts

ATM access is a crucial factor for many people. Banks like Chase and Bank of America have extensive ATM networks, while online banks like Ally and Discover reimburse out-of-network ATM fees, giving you flexibility and convenience.

High-Yield Checking Accounts: Are They Worth It?

High-yield checking accounts offer interest on your balances, which can be an excellent way to grow your money. However, they often come with requirements like maintaining a minimum balance or making a certain number of transactions each month. Evaluate whether these conditions align with your financial habits before opting for one.

How to Avoid Hidden Checking Account Fees?

Hidden fees can quickly add up and eat into your savings. To avoid these, carefully read the terms and conditions of the account. Look for accounts with no overdraft fees, low ATM fees, and no maintenance charges. The best banks for checking accounts are upfront about their pricing structures.

Best Bank for Checking Account for Students

Students often need checking accounts with no minimum balance requirements and low fees. Banks like Chase and U.S. Bank offer student-friendly checking accounts with features like free ATM access and easy online banking.

Best Bank for Checking Account for Small Businesses

Small business owners require checking accounts with features like higher transaction limits, integration with accounting software, and dedicated support. Banks like Chase and Bank of America offer excellent options tailored to small businesses.

What to Consider When Switching Banks?

If you’re thinking about switching banks, consider factors like transfer fees, account closure fees, and the time it takes to transition. Make sure your new bank offers all the features you need and aligns with your financial goals.

In conclusion, finding the best bank for checking accounts requires careful consideration of your financial needs and habits. By evaluating factors like fees, customer service, and accessibility, you can choose a bank that simplifies your financial life and helps you achieve your goals.

You Might Also Like

Basil Leaves: The Green Treasure Of NatureDiscover The Perfect Molasses Substitute: A Complete Guide

Unveiling The Delicious World Of Pork Spare Ribs

Refreshing And Nutritious: Exploring The World Of Healthy Soda

How Much Does A Lamborghini Cost? A Comprehensive Guide To Understanding Lamborghini Prices

Article Recommendations

- Alex Lagina And Miriam Amirault Wedding

- The Life And Family Of Niall Horan An Indepth Look At His Wife And Son

- Laura Wrights Children All You Need To Know